Why Hiring Your Children is a great tax strategy?

- Samuel Lai

- Jun 29, 2022

- 4 min read

Summer vacation is coming soon. Some parents prepared a well-planned summer schedule for their children, and some parents want their children to work with them in their family's own business.

Just last year, a lot of parents requested me to add their children to their payroll, because they saw online that hiring children who are under 18 could save some taxes. In fact, hiring children is a legit tax-saving strategy. You and your children could get tax benefits from it. However, there are some Do and Don’t actions to take when you hire your children, and we are going to explore them in this article.

Tax Benefit of hiring your children who are under 18 – You should do the following things

Tip#1 You should pay your children up to $12,950 (in 2022) for tax free

You can pay your children up to $12,950 (in 2022) or less for tax free. Not only the children are exempt from paying taxes on that amount, but neither do you as the business owner (this saves you from withholding both income taxes as well as payroll taxes). You also get to take up to the $12,950 you paid your children and deduct it as a business expense.

Under the rule, children who are under the age of 18 are exempt from Social Security Tax, Medicare Tax, and Federal Unemployment Tax (FUTA). In sum, they are called payroll taxes. In general, you, as a business owner, would need to pay payroll when you hire a W2 employee. Since you hire your children who are under the age of 18, you can save the payroll tax.

Thanks to the Standard deduction, each individual, including our children, doesn’t pay taxes on the first $12,950 they earned in 2022. If you pay more than $12,950 to your children, they will just need to pay tax for the incremental amount.

Also, you can still claim your children as dependents on your tax return and take the child tax credit if you qualify.

Tip#2 Your children can contribute up to $6,000 to their Roth IRA. Not a good idea for traditional IRA

It would be a smart move if your children can contribute $6000 to their Roth IRA from their paychecks. They can withdraw all or part of the annual Roth contributions without any federal income tax or penalty to pay for college or for any other reason. In contrast, it is not a good idea to contribute to a traditional IRA, because your children won’t likely to receive tax deductions from traditional IRA contributions. In addition, your children make deductible contributions to a traditional IRA, any subsequent withdrawals must be included in gross income. Even worse, traditional IRA withdrawals taken before age 59½ will be hit with a 10% early withdrawal penalty tax unless an exception applies.

Be careful of hiring your children who are under 18 – Don’t do the following things

Tip#3 You have to set up your children as W2 employees. Not to pay them as 1099 contractors

It is a common mistake that business owners to assume the tax benefit will be the same if they cut them a check or wire the money to their children’s checking account. The answer is absolutely not. The payroll taxes will not be exempt if the children are not hired as W2 employees. Instead, children will need to pay self-employed tax when they file their tax returns as independent contractors.

Tip#4 If you have an S or C Corp, this strategy might not be the best for you

Under the tax rules, the IRS only allows any sole prop or partnership (LLC) that is wholly owned by a child’s parents to pay wages to children under 18 without having to withhold payroll taxes.

If you have an S or C corp, you don’t receive the benefit of avoiding FICA when paying your children. It will be treated as a regular employee that you will pay the payroll tax from the business side and withhold Social Security and Medicare Tax on your children’s paychecks.

Advance Tax Planning

How can you still get the tax benefits for hiring my children even if you are incorporated as a C Corp?

Case study: TEA Inc is a C-corporation in Florida. Mr.T is the CEO and the only shareholder of the company. Mr.T has 5 children (A, B, C, D, & E), and they are all under the age of 18 and eligible to work. They want to work with their dad and earn some income for college.

Mr.T wants me to simply add his 5 children to the payroll for TEA Inc. However, I know there is a way to help him get the most tax benefit from hiring his children, so I took some time to prepare the tax planning solution for him.

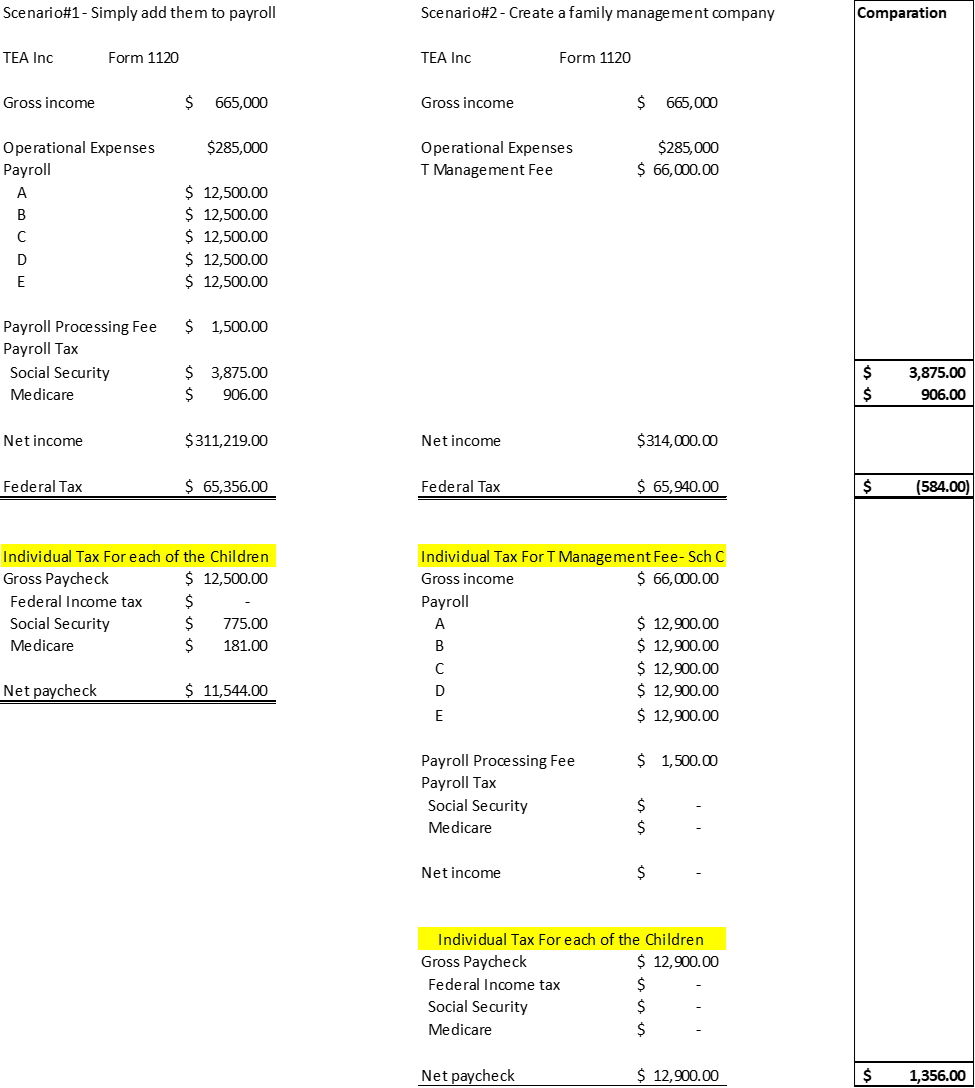

Under scenario #1, if he is going to simply add his children to the company’s payroll and assume there are not other employees other than his 5 children. The net income of TEA Inc would be $311,219 after all the expenses, and the tax liability is $65,356

For each of his children, they will receive gross paychecks of $12,500. Since each of their income is less than the standard deduction, they don’t need to pay Federal tax, but the company is required to withhold payroll taxes for them. Therefore, the net pay for each of them is $11,544.00

My tax planning advice to him is that to create a family management company (Single-member LLC under Mr. T’s name) called “T Management LLC”. TEA Inc can pay the management fee to T Management LLC, and T Management LLC hires the children to work for TEA Inc. Adopting this tax strategy, TEA Inc can save $4,781 from payroll tax. Instead of keeping that money, TEA Inc can increase the salary for each child to $12,900. As a result, the net income of TEA Inc would be $314,000 after all the expenses, and the tax liability is $65,940. However, it needs to pay an additional $584 Federal tax than scenario#1 but it saved $4,781 from payroll tax.

For T Management LLC, the net income would be zero since all the management fee that it received from TEA Inc would pay out to the children and payroll processor. For the children, they won’t see any taxes in their paychecks, because they are exempt from payroll tax and earn less than $12,950.

With this tax strategy, TEA Inc could save $4,197, and Mr.T’s 5 children could save $6,780 in total. More importantly, they can use the same tax strategy every year until all the children over the age of 18.

Comments